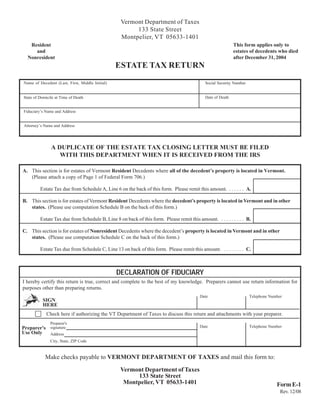

vermont state tax form

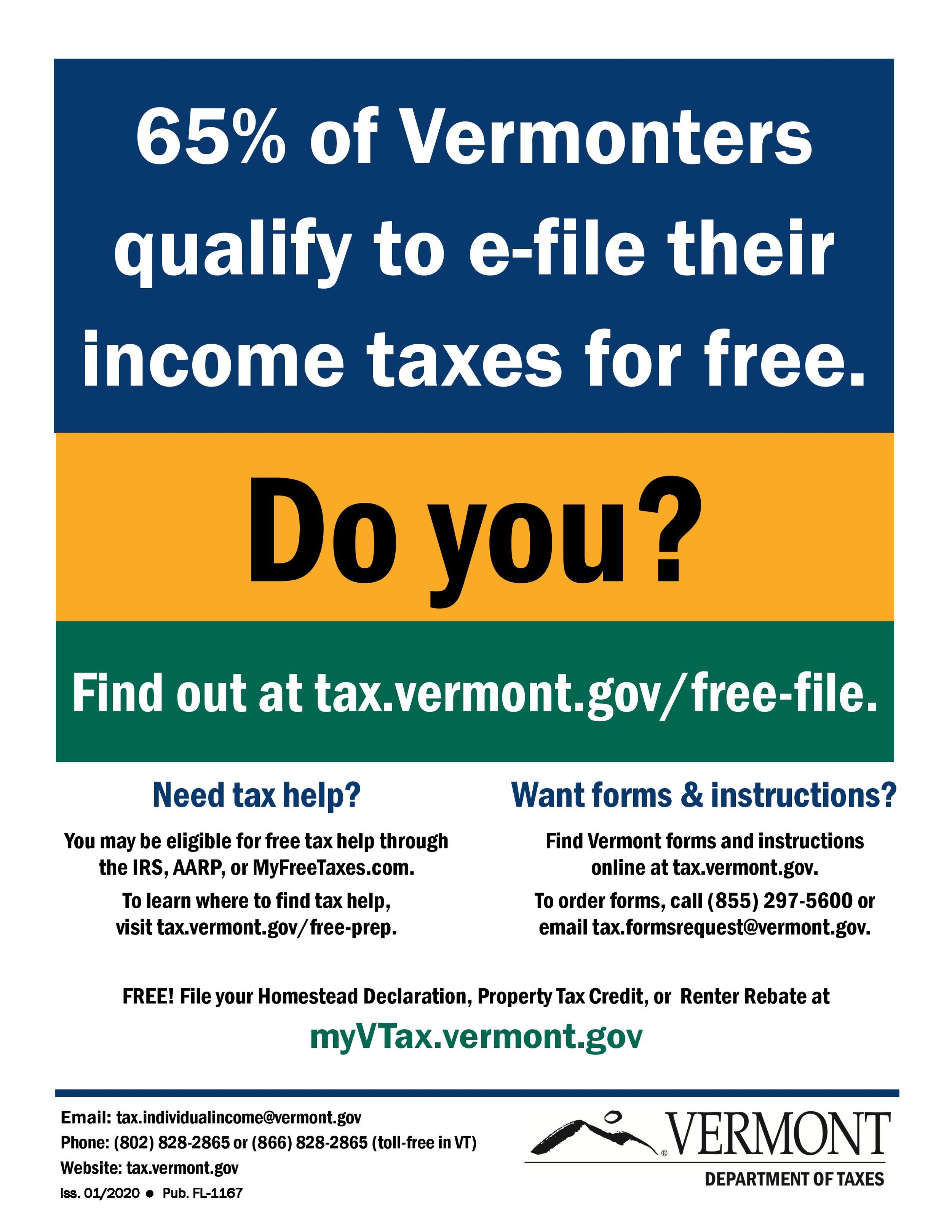

Voter Services Register to vote and find other useful information. Vermont Department of Taxes.

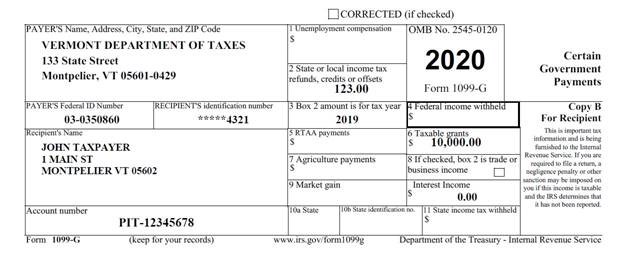

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

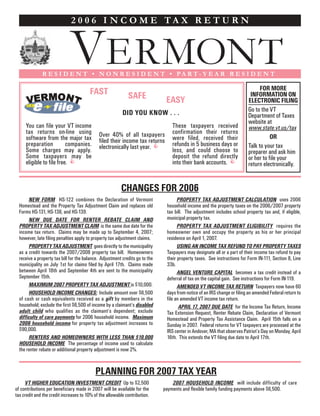

. Office of Governor Phil Scott 109 State Street Pavilion Montpelier VT 05609 Phone. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

Estimated tax payments must be sent to the. PA-1 Special Power of Attorney. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date.

Form 1095-B is your proof of qualifying health coverage for each month you had it during the. Form IN-114 - Estimated Income Tax. Nonresident alien who becomes a resident alien.

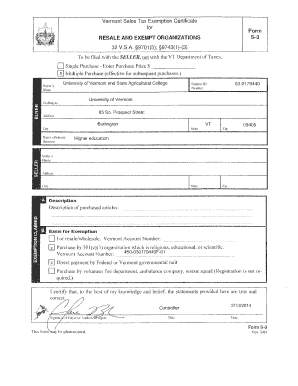

If you file a. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. Details on how to only prepare and.

W-4VT Employees Withholding Allowance Certificate. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. If claimants believe their 1099-G to be incorrect.

802 828-2301 Toll Free. Ad Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now. Vermont Individual Income Tax Return.

Locate a Vital Record Search and request certificates. If you file Vermont state taxes you will need to report the months that you had health coverage. To get started you will need your vehicles VIN purchase date and mileage.

2022 Form IN-114 Individual Income Estimated Tax Payment Voucher. Vermont School District Codes. Information provided on 1099-G forms is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor.

Taxes for Individuals File and pay taxes online and find required forms. Vermont Form IN-111 2018. The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875.

Vermont State Income Tax Return forms for Tax Year 2021 Jan. Please mail your written request to. Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone.

PUBLIC INFORMATION REQUESTS TO. Enter your vehicle information and receive your estimated tax. For classic or collectible vehicles call 8028282000.

TaxFormFinder provides printable PDF copies of 52 current. Please include your full name company name if. The state income tax table can be found inside the Vermont Form IN-111.

Vermont State Income Tax Forms for Tax Year 2021 Jan. Complete Edit or Print Tax Forms Instantly. Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now.

PVR-4342pdf 6113 KB File Format. To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Wednesday March 16 2022 - 1200.

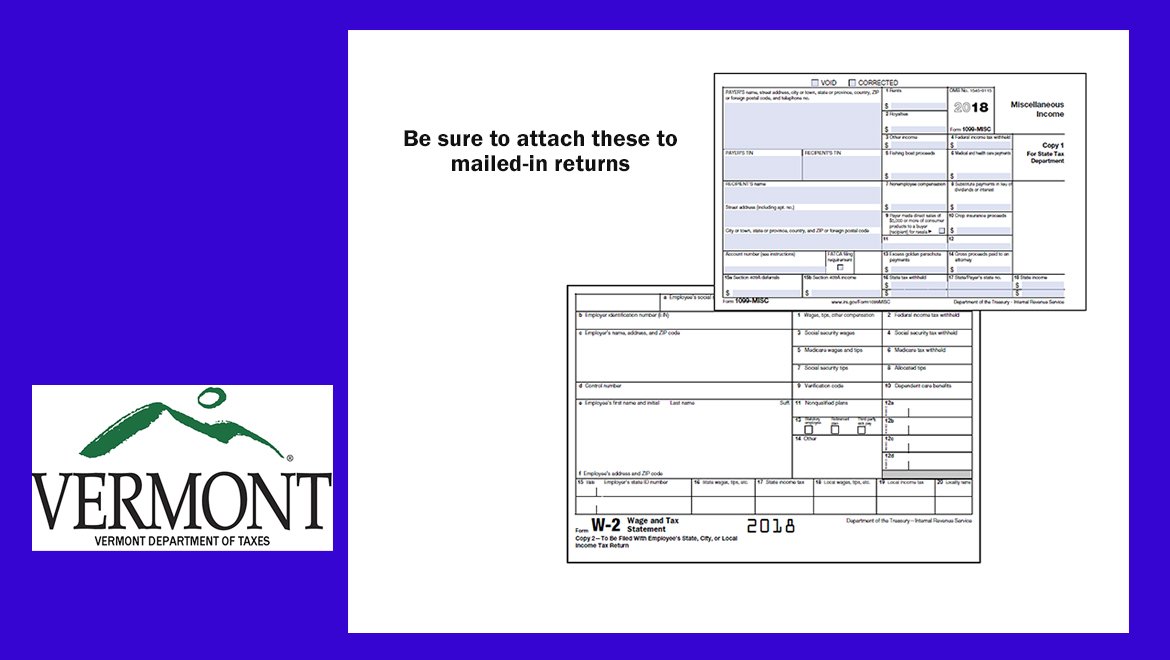

Taxpayers in Vermont file Form IN-111 the long version of the Vermont Individual Income Tax Return for their income. The appropriate Form W-8 or Form 8233 see Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. Lease Excess Wear Tear Excess Mileage.

IN-111 Vermont Income Tax Return. Monday February 14 2022 - 1200. Ad Access Tax Forms.

Form PVR-4342 Grand List Extension Request. IN-114-2021pdf 6192 KB File Format.

Vt Dept Of Taxes On Twitter The Vermont Department Of Taxes Is No Longer Participating In The Combined Federal State Program For Submitting W 2 And 1099 Forms With The Irs You Must Now

How To File And Pay Sales Tax In Vermont Taxvalet

Vermont Tax Information Town Of Craftsbury

Form In 154 State Local Income Tax Addback

Vermont Enacts Major Corporate Tax Reform Package Rath Young Pignatelli

Vermont Tax Information Town Of Craftsbury

Vt Tax Dept Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Sun Community News Montpelier The Vermont Department Of Taxes Last Week Mailed 1099 G Forms To 21 000 Taxpayers That

Initial Request For Copy Of Debtors Federal Income Tax Return S L 1

Form 250 Act 250 Disclosure Statement

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

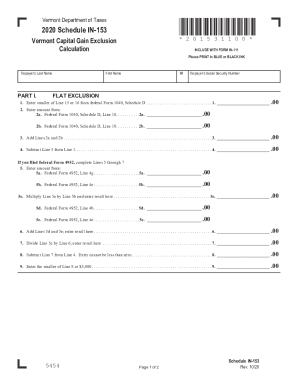

Vermont 153 Form Fill Out And Sign Printable Pdf Template Signnow

Vermont Department Of Taxes Facebook

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Wh 435sh Safe Harbor Worksheet

Vermont Department Of Taxes Need A Vermont Income Tax Booklet Including Forms Stop By 133 State Street In Montpelier Go Around The Back Of The Building And Take One From The

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

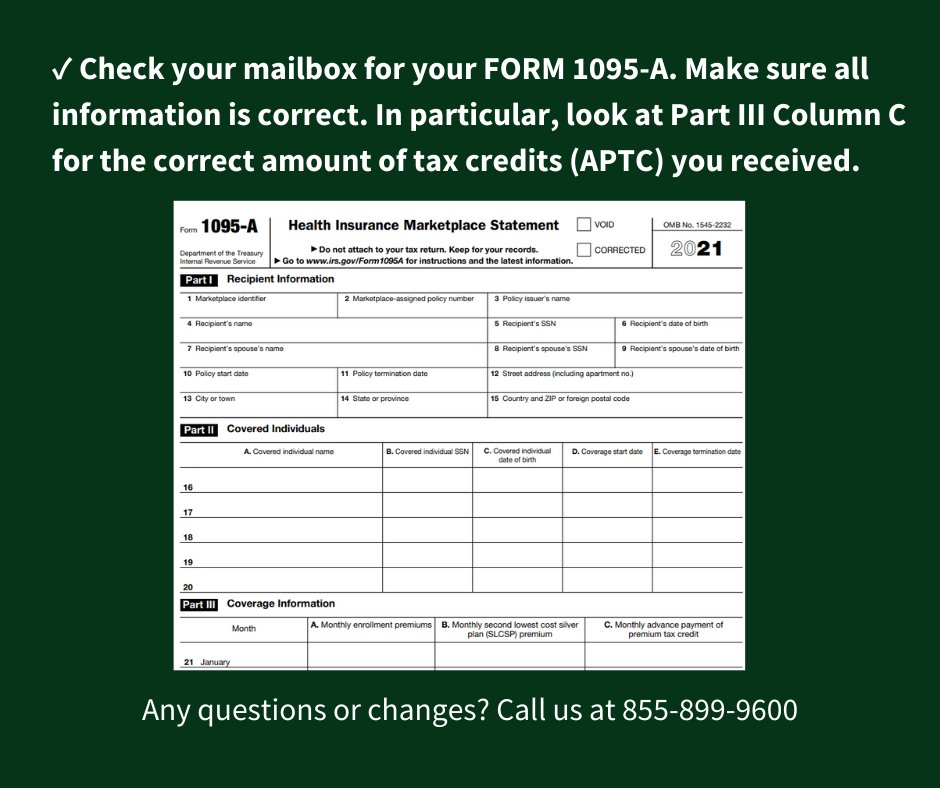

Vt Health Connect On Twitter Ready To File Your Taxes If You Were Enrolled In A Qualified Health Plan In 2021 We Sent You Form 1095 A You Will Need This Form To